Secretarial Audit under Companies Act 2013?

Secretarial Audit

Secretarial Audit is a process conducted by an independent professional to check whether the Company has complied with the provisions of various laws, rules and regulations. This is a tool whereby regulators monitors companies for compliances as required by the stated laws and processes.

Who can be appointed as a Secretarial Auditor?

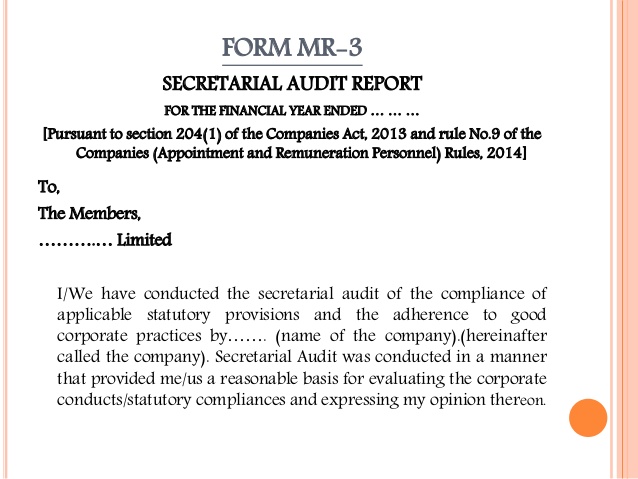

In terms of section 204(1) of the Companies Act, 2013, only a member of the Institute of Company Secretaries of India holding certificate of practice (i.e. Company Secretary in Practice) can conduct Secretarial Audit and furnish the Secretarial Audit Report to the Company in Form – MR-3.

The Secretarial Auditor is required to be appointed by the Board Resolution passed by the Board of Director of the Company in their Board Meeting.

Applicability of Secretarial Audit as per Companies Act, 2013

1. Every listed company

2. Every public company having a paid up share capital of Rs. 50 crore or more; or

3. Every public company having a turnover of Rs. 250 crore or more; or

4. Every company having outstanding loans or borrowings from banks or public financial institutions of Rs. 100 crore or more.

Applicability of Secretarial Audit as per SEBI (LODR), 2015

Regulation 24A of SEBI (LODR) Regulations, 2015

1. Every listed entity

2. And its material unlisted subsidiary incorporated in India

*Material Subsidiary shall mean a subsidiary, whose income or net worth exceeds ten percent of the consolidated income or net worth respectively, of the listed entity and its subsidiaries in the immediately preceding accounting year.

Scope of Secretarial Audit

Basically the scope of Secretarial Audit includes reporting compliance of following five specific laws:

- Companies Act, 2013

- Securities Contract (Regulation) Act, 1956

- Depositories Act, 1996

- Foreign Exchange Management Act, 1999

- Rules and Regulations under the SEBI Act

Other than this the auditor will also check the company’s compliance with,

- The Secretarial Standards which the ICSI issues from time to time.

- The Listing Agreement of the company with the appropriate stock exchange.

Objectives of Secretarial Audit:

1. To protect the interest of various stakeholders.

2. To ensure effective compliance mechanism.

3. To protect the top Management from undesirable hassles.

4. To avoid any unwarranted legal actions/penalties by law enforcing agencies.

5. To reduce the risk of consequences of non-compliance.

6. To strengthen the image and goodwill of the Company.

Punishment for default:

As per Section 204(4) of the Companies Act, 2013 if a company or any officer of the company or the company secretary in practice, contravenes the provisions of this secretarial audit, then

- The company, or

- Every officer of the company, or

- The company secretary in practice,

who is in default, shall be punishable with

Fine:- Minimum Rs. 1 lakh.

Maximum Rs. 5 lakh.

Conclusion:

Secretarial Audit is always in the better interest of every corporate management. As an independent professional i.e a practicing company secretary certifies whether the company has carried out the compliance under the Act. This will also cater to the needs of the shareholders, creditors and employees.

An audit is to be on the principle of “Prevention is better than cure” rather than post-mortem exercise and to find faults.

Source: https://www.mca.gov.in/

Excellent

Great. Well written