{Reconciliation of Share Capital Audit Report}- Half Year Compliances

The Ministry has introduced the FORM PAS-6 vide notification Letter Dated 22nd May 2019, Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019 and Shall come into force with effect from 30th September 2019.

This further extended to the post 60 Days from the deployment of the form vide notification dated 28th November 2019 i.e 15th July 2020 is the date of deployment of the form so the due date for the submission of the same is 13th September 2020 but further extended upto 30th September 2020 under CFSS Scheme (Relief under pandemic by Ministry’s).

The purpose of the deployment of the form is to reconcile the Share Capital Audit report on half-yearly basis and it could bring under the notice of the Depositories if any difference observed in its Issued Capital held in demat form.

Applicability

Every UNLISTED PUBLIC COMPANY –

- Issuing the securities only in dematerialised form; and

- Facilitate dematerialisation of all its existing securities

in accordance with provisions of the Depositories Act, 1996 and regulations made there under;

As per rule (8) of Chapter III of Part 1 of The Companies (Prospectus and Allotment of Securities) Rules 2014 substituted by the Third amendment rules 2019 mandates the above-mentioned Companies to submit Form Pas-6 within 60 days from the conclusion of each half-year i.e 30th September and 31st March every year hereinafter duly certified by a Company Secretary in Practice or Chartered Accountant in Practice.

Due Date for the Submission of the FORM PAS-6

| Period under review | Reporting Due Dates |

| For the half year period ending on 30th September | 29th November |

| For the half year period ending on 31st March | 30th May |

However below herewith enlist the exclusive/exempted companies to comply with this rule;

- Nidhi Company

- Government Company

- Wholly Owned Subsidiary

Thus above mentioned Companies doesn’t have to comply with the filling of the stated forms/rules.

Key Points to be filled in the form

- ISIN (International Securities Identification Number) { Mandatory to obtain for all unlisted public Company}

- Period under review

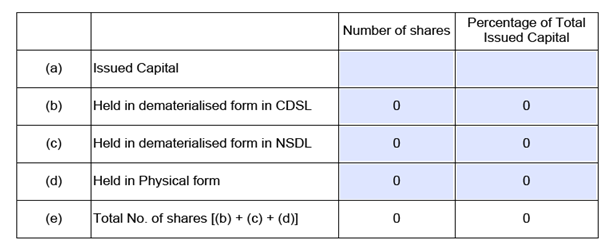

- Detailed Capital of the Company

- Reason for difference if any in clause C(a) and C(e)

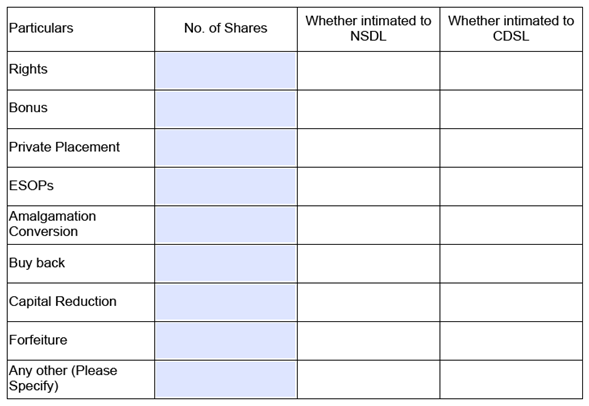

- Details of changes in share capital during the half-year under consideration

Further, Details of Shares (demat or physical) held and certain other Information’s are also to be reported through this form as such;

- Shares held by Promoters, Directors, KMPs

- Total Number of demat requests, if any, confirmed after 21 days and

- Total Number of demat requests pending beyond 21 days with the reasons for delay

- Details of Company Secretary of the Company, if any

- Details of Practicing Professional certifying the form

Processing Type

The form will be processed in STP mode.

Fees Applicable/Rules

Fees payable is subject to changes in pursuance of the Act or any rule or regulation made or notification issued thereunder.

| For any detailed enquiry concern suggestions Kindly mail us at Info@Corpindcart.com |